News of the Death of Car Affordability in 2025 Was Greatly Exaggerated.

Remember the dire predictions?

🚨 March 26, 2025: The New York Times estimated that tariffs "would add $6,000 to the price of a car made in Mexico or Canada."

🚨 April 3, 2025: The Wall Street Journal warned that "Trump's auto tariffs are about to give another boost to car prices that have already surged."

Fast forward to today:

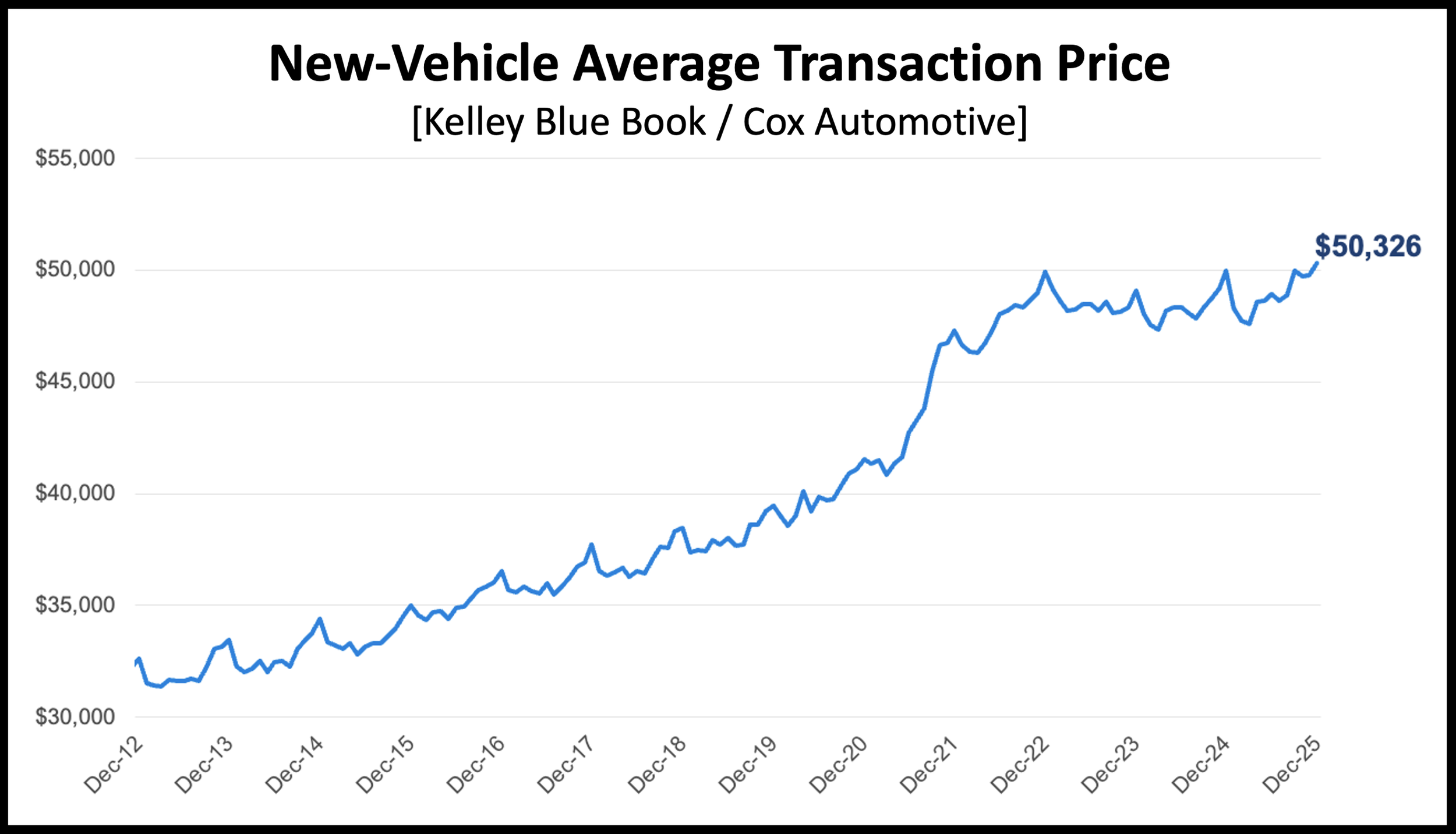

➡️ New Vehicle Prices Barely Moved Year-Over-Year in the US

- Industry-wide Average Transaction Price (ATP) in December 2025: $50,326—up just 0.8% from December 2024.

- That increase is well below typical annual inflation and nowhere near the "surge" predicted.

- MSRP rose 1.2%, but automaker incentives jumped to 7.5% of ATP, cushioning the blow to consumers.

Notable ATP movement in 2025 vs 2024 (US):

- Mercedes-Benz AG -6.2%

- Tesla -2.9%

- General Motors +1.1%

- Toyota Motor Corporation +1.3%

- Ford Motor Company +2.0%

- Volkswagen Group +4.6%

➡️ Used Vehicle Prices Stabilized (US)

- Manheim Index showed wholesale prices up just 0.4% year-over-year.

- Used retail sales up 2% for the full year—healthy, stable demand.

-Cox Automotive expects normal depreciation returning in 2026.

➡️ The Real Price Spike Happened in 2021-2022

- Average new vehicle transaction prices jumped from $41K to $50K+ in the US.

- That's a 22% increase. Before any tariff discussions.

➡️ Outlook into 2026 Appears Stabilizing (US)

- Current inventory: 3.01 million units, with ample 73-88 Days Supply (historic average is approx. 60-70 days)

- More than 54% of vehicles listed below MSRP (61% in compact utilities)

- Auto loan rates declining as we start 2026

[Thank you to Cox Automotive Inc. for the data]